How To Find Out Whos Garnishing My Check

Wage garnishment happens when a court orders that your employer withhold a specific portion of your paycheck and send it straight to the creditor or person to whom you owe money, until your debt is resolved.

Child support, consumer debts and student loans are mutual sources of wage garnishment. Your earnings will be garnished until the debt is paid off or otherwise resolved.

Y'all accept legal rights, including caps on how much can be taken at one time. And you can take steps to lessen the consequence and help you bounce back.

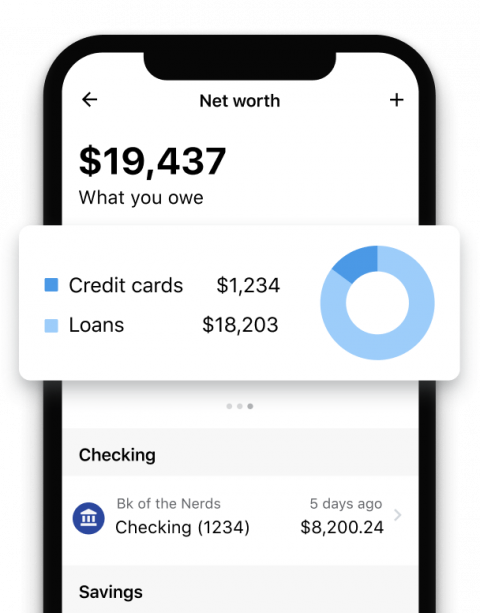

Watch your debts dwindle

Sign up for an account to link your cards, loans and accounts to manage them all in one place.

Types of wage garnishment and how it happens

Wage garnishment is more common than you lot might think. A report past ADP Research Constitute found that 7.2% of the 13 one thousand thousand employees it assessed had wages garnished in 2013. For workers ages 35 to 44, the number hit x.five%. The pinnacle reasons were child back up; consumer debts and student loans ; and tax levies .

There are ii types of garnishment:

-

In wage garnishment , creditors can legally require your employer to hand over office of your earnings to pay off your debts.

-

In nonwage garnishment , commonly referred to equally a bank levy, creditors tin tap into your banking concern account.

Garnishment often happens when a creditor sues you for nonpayment of a debt and wins in court. Sometimes, though, a creditor tin forcefulness garnishment without a court club, for example, if you owe child support, back taxes or a remainder on federal student loans.

The court will ship notices to yous and your depository financial institution or employer, and the garnishment volition begin in five to 30 business days, depending on your creditor and state. The garnishment continues until the debt, potentially including courtroom fees and involvement, is paid.

How much of your wages can exist garnished?

Hither's an overview of the federal limits on how much of your disposable income a creditor can have. (When it comes to wage garnishment, "disposable income" means anything left after the necessary deductions such equally taxes and Social Security.)

| Type of debt | Percent of weekly disposable income that can be taken |

|---|---|

| Credit menu and medical bills, personal loans and most other consumer debts | Either 25% or the amount by which your weekly income exceeds xxx times the federal minimum wage (currently $seven.25 an hour), whichever is less. Here's how that breaks downwards: • If your weekly disposable income is $290 or more than, 25% is taken. • If information technology's betwixt $289.99 and $217.51, the corporeality above $217.51 tin can be taken. • If it's $217.50 or lower, garnishment is non immune. |

| Kid support and alimony | 50% if y'all are supporting another child or spouse; otherwise, upwards to threescore%. If you are more than 12 weeks belatedly in payments, an additional v% may be taken. |

| Federal educatee loans | xv% |

| Taxes | Generally, upward to fifteen%. The Internal Revenue Service will make up one's mind the amount taken based on standard deductions and the number of dependents yous take. |

Note: State laws around garnishment vary profoundly. Your state may have boosted protections that shelter more of your income or bank business relationship residuum, or information technology may offer exemptions for situations like being head of household with dependent children. In near cases, debtors must learn about exemptions and ask for them on their own. Nonwage garnishment, which is less common, is generally less regulated and has fewer restrictions for creditors.

What yous can do about wage garnishment

You accept some rights in the wage garnishment process, but in near states, it's your responsibleness to be aware of and exercise these rights.

-

You accept to be legally notified of the garnishment.

-

You can file a dispute if the detect has inaccurate data or you believe you don't owe the debt.

-

Some forms of income, such equally Social Security and veterans benefits, are exempt from garnishment as income. However, they could exist subject to seizure in one case in your depository financial institution business relationship .

-

You can't exist fired for having 1 wage garnishment, only you'll lose this protection if you incur more one garnishment.

If you believe the judgment was made in fault or it's causing undue harm to your finances, y'all can challenge the garnishment .

What to do when you become a garnishment judgment

Starting time, advisedly read the judgment to verify that all of the information is accurate. Make sure that information technology's not something yous already paid and that it'southward in fact your debt. If information technology is, consider how much money will be taken and what it will hateful for your fiscal situation.

Then weigh what to practise next. If y'all oasis't washed so before, yous may want to consult a consumer constabulary attorney or local legal aid to make up one's mind what'due south best for you. You accept three primary options:

Work out a different deal

Contact your creditors. "A lot of consumers underestimate the ability of a conversation," says Tara Alderete, director of education at Clearpoint Credit Counseling Solutions. "Wait at a budget, see how much you lot owe, what you can pay, and then just telephone call the creditor to see if y'all can work out a payment plan. Creditors and consumers e'er accept that ability."

Challenge the judgment

If you believe the garnishment was fabricated in error, volition cause undue harm or is beingness improperly executed, you can object in court. You'll have to deed quickly. Y'all may have as few as five concern days to competition the ruling.

Accept the garnishment

Yous can pay off the garnishment in installments as the judgment states or pay in a lump sum. Borrowing coin from a family member or taking out a personal loan to pay off the judgment, which is possible even with the garnishment on your credit report, could give you quick relief from the stress of a prolonged serial of payments.

It tin exist embarrassing to have your employer know you've been sued for debt, but information technology'due south all-time to be honest with your managing director or human relations department.

"Wage garnishment tin can crusade stress in the piece of work environs, so be proactive in talking with your employer," Alderete says. "Have a chat where y'all say what'south happening and that you don't want it to become a problem."

If wage garnishment is a fiscal burden

If yous don't see a path frontward from wage garnishment, consult the free services of a nonprofit credit counselor to discuss your debt relief options , such as a repayment program or bankruptcy.

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score. Simply there a few like shooting fish in a barrel ways to eternalize your credit, both during and after wage garnishment.

Building a budget — and sticking to it — tin can help you stay on meridian of your finances to avoid another garnishment. From in that location, y'all can take out products such as a secured credit card to work on restoring your credit .

Source: https://www.nerdwallet.com/article/finance/wage-garnishment

Posted by: farrellsymeave.blogspot.com

0 Response to "How To Find Out Whos Garnishing My Check"

Post a Comment